- The Plan for Social Security proposed in this Report is first and foremost a plan of how social insurance should be organised, with national assistance and voluntary insurance as subsidiary methods, for maintenance of income. The method of organisation is independent of the precise amounts to be given each week as benefit or pension. It might be difficult today to take definite decisions on questions of amount, because the future level of prices is uncertain; the final figures must be written into the plan when the time and conditions of its coming into operation are known. But, for several reasons, it is necessary to suggest the rates of benefit or pension that would be suitable, on some reasonable assumption as to price levels. Only by giving figures can the relation of different scales of benefit to one another and to the cost of living be shown. Only in this way can the scale of contributions required for any given scale of benefits, and the suggested distribution of the total cost between the different parties to the scheme, be set forth in simple terms. For this purpose, the provisional scale of benefits set out in paras. 401-402 has been adopted. Subject to the difficulty of finding any single rate of benefit to cover the differing rents paid by different households, this scale is suggested as providing subsistence for normal cases, on the assumption of a cost of living after the war, including rent, about 25 per cent, above that of 1938. The point at which, and the extent to which it would be desirable to change this scale to suit a different cost of living are matters of judgment. In this scale, the standard rate of joint benefit for a man and wife together is put at 40/- a week, applying to unemployment, disability and retirement alike. The rates of benefit corresponding to this joint standard, for single men or women, for men or women whose spouses are gainfully occupied, for young persons and boys and girls, and for special risks, such as maternity and widowhood, are set out in para. 401.

-

The actuarial and financial problems involved in the Plan for Social Security, on the assumption of this scale of security benefits, are examined in detail in the Memorandum by the Government Actuary which forms Appendix A to the Report. Here the financial problem is considered in general terms, and the principles to be followed in obtaining the money required to meet the expenditure involved in the plan are explained and discussed. In this discussion and in the Memorandum of the Government Actuary, it is necessary to assume a date for the beginning of the scheme, so that the calculations may be related to the expected numbers and age constitution of the population. The date taken for this purpose is 1st July, 1944; estimates are given for 1945 as the first year of benefit and for 1965 as the first year of contributory pensions at the full rate. This assumes twenty years for the length of the transition period during which the rate of contributory pensions will rise by stages. As is stated in paragraph 252 there is nothing sacred about this number of years. If it became necessary to lengthen the transition period and postpone the coming of the full rate of contributory pensions, this could be done without breach of contract with the contributors, who would have paid at the new contribution rates only for twenty years of their working lives in place of the forty or fifty years for which their successors will pay. If, on the other hand, it appeared possible and desirable to shorten the transition period and make the rate of contributory pensions rise more rapidly, this would not affect the principles of the scheme.

-

In addition to social insurance, the Plan for Social Security involves provision of other services which must be taken into account in framing a Social Security Budget. One of these services is national assistance, which will be administered by the Ministry of Social Security, but will be financed separately from the insurance scheme. Under the arrangements for transition the scope of national assistance, though smaller than that of assistance by the State and by Local Authorities at present, will be substantial at the outset of the scheme. It will diminish continuously, as the rate of contributory pension rises and fresh classes of contributors qualify for pensions. More important than national assistance as permanent elements in the Security Budget are the assumptions A and B of the plan. The plan assumes, first, a general system of children’s allowances, sufficient to meet the subsistence needs of all dependent children when the responsible parent is in receipt of any insurance benefit or pension, and of all such children except one in other cases; the allowance required for this purpose in addition to existing provision in kind, is taken as 8/- a week on an average of children of all ages. The plan assumes, second, the establishment of comprehensive health and rehabilitation services providing treatment for all citizens without a charge on treatment. Expenditure in realising these two assumptions falls appropriately in the Security Budget. Assumption C of the plan, namely maintenance of employment, is a matter not so much of expenditure as of organisation. In any case any expenditure involved in it does not fall into the Security Budget.

Expenditure In 1945 And 1965

- On the basis of the provisional rates of benefit and pension suggested in para. 401, the estimated total expenditure to be included in the Security Budget is set out in Table XII as for the first full year of the scheme, assumed to be 1945, and twenty years thereafter, that is to say, 1965. The basis of the estimates is explained briefly in paras. 269-70 and more fully in the Memorandum by the Government Actuary. It will be seen that the total Security Budget both on purposes covered by the present schemes and on new purposes is put at £697 million in 1945, and £858 million in 1965. Of these totals £367 million in 1945 and £553 million in 1965 are in respect of social insurance, and will be met from the Social Insurance Fund, with self-contained finance subject to review by the Social Insurance Statutory Committee proposed in Change 22.

TABLE XII

Estimated social security Expenditure 1945 and 1965

| 1945 £ millions | 1965 £ millions | |

| Social Insurance : — Unemployment Benefit (including training benefit) |

110 57 15 126 29 7 1 4 18 |

107 71 15 300 21 6 3 12 18 |

| Disability Benefit other than Industrial | ||

| Industrial Disability Benefit, Pensions and Grant | ||

| Retirement Pensions | ||

| Widows’ and Guardian Benefit | ||

| Maternity Grant and Benefit | ||

| Funeral GrantCost of Administration | ||

| Total Social Insurance |

367 39 5 3 110 3 170 |

553 25 5 2 100 3 170 |

| National Assistance : —Assistance Pension | ||

| Other Assistance | ||

| Cost of Administration | ||

| Children’s Allowances | ||

| Cost of Administration | ||

| Health and Rehabilitation Services | ||

| TOTAL ………………………………………………………………………………………………. |

697 |

858 |

- The whole increase of social security expenditure between 1945 and 1965 is in respect of retirement pensions, reflecting both the growing proportion of pensioners in the population and the transition to full contributory pensions. The total of £300 million for retirement pensions in 1965 is based on the assumption that for all the persons within the present contributory classes single pensions rise by I/- and joint pensions by 1/6 every two years from 1945 to 1965, irrespective of the date at which they retire, but that for the new pension classes (Classes II and IV and those now excepted from contribution in Class I) the contributory principle is applied strictly, so that, once such a man has retired, his pension does not change thereafter. This is in accord with the proposal in paras. 242-243 to treat these two groups of insured persons on different lines. The financial consequences of assimilating the treatment of the two groups are given in the last two sentences of para. 243.

-

The following notes deal with some of the principal points in the table :—

(1) The cost shown in 1945 for industrial disability includes the whole cost of existing cases of prolonged disability; all the present weekly payments will be raised to the new rates. In respect of these cases there will be an offset against the amount shown, in the reserves held by the insurance companies and associations, against their liabilities at the present rates.

(2) Expenditure on funeral grant in 1945 is lower than in 1965 by reason of the proposed exclusion from this grant of persons over 60 at the beginning of the scheme, on the assumption that they will already have made provision for this need.

(3) The figure given for the cost of the health and rehabilitation services is a very rough estimate requiring further examination. No change is made in this figure as from 1945 to 1965, it being assumed that there will actually be some development of the service, and as a consequence of this development a reduction in the number of cases requiring it. The estimate assumes that hospital treatment with all other treatment is included in the health service in virtue of the compulsory social insurance contribution, that is, without further voluntary contributions or charge on treatment; this proposal is subject to the further enquiry suggested in para. 437.

(4) In estimating the cost of disability benefit other than industrial the Government Actuary for reasons given in para. 22 of his Memorandum has assumed a sickness rate 12£ per cent, above that which now forms the basis of national health insurance finance. It is reasonable to hope that by the development of preventive and curative treatment the actual rate of claims will be kept materially below this assumption.

(5) The figure of £25,000,000 entered as the cost of assistance pensions in 1965 covers several different groups, of which the most important are the following:—

(a) Women between 60 and 70 not entitled to present contributory pensions, in so far as they are in need, are now dealt with by public assistance. It may be assumed that with assistance pensions available the number of claimants will increase materially.

(b) Persons now outside the present scope of contributory pensions who are so old that they either obtain exemption from contributions altogether or reach the retiring age long before 1965 so that their pensions are inadequate and they are in need.

(c) Persons in Classes II and IV who obtain exemption from contribution on the ground of having less than £75 a year of income (para. 363 (iii)) and so do not qualify for contributory pensions. The first two groups represent the survivors from the present system. The numbers and expenditure in respect of each of them is likely to decline very rapidly soon after 1965. In the third group the Government Actuary (Appendix A, para. 59) has allowed continuing expenditure on assistance pensions at the rate of £15 million a year, representing 240,000 full assistance pensions. It is reasonable to hope that the number of persons in Classes II and IV who, on grounds of poverty, will need exemption from contributions will be much less than this.

(6) The estimate of the cost of administration as £18 million in respect of social insurance and £3 million in respect of national assistance in 1945 is based on the following considerations. The actual administrative expenditure in 1938-39 was £14 million in respect of insurance services (excluding workmen’s compensation) and about £6-9 million in respect of assistance both central and local. The scope of assistance in which the administrative costs are relatively high will be greatly decreased and should certainly not exceed the £3 million shown. The cost of administering industrial disability benefit and pensions should not be more than 10 per cent, of the much higher benefits provided {as is shown in Appendix E, the present mutual companies in mining work well below this percentage), i.e., should not exceed.£1-5 million leaving £16-5 million for the rest of social insurance as compared with £14 million spent in 1938-9. Setting the increase of prices and in the total scope of insurance against the economies that will follow from co-ordination this appears reasonable.

(7) The sum of £57 million entered for disability other than industrial in 1945 allows for putting all persons on present disablement benefit at the beginning of the scheme up to the new rate of disability benefit. If, as is suggested in para, 353 (5), permanent invalids among these people are treated as pensioners on the rising pension scale, the cost of disability benefit in 1945 will be reduced by about £10 million (Appendix A, para, 56).

- Table XII shows the total expenditure involved in the Plan for Social Security. This is not, of course, new expenditure; a great deal of it is already being incurred. The extent to which additional charges will be imposed on the various parties to social insurance can be considered best after examining the method proposed for distributing the total cost. How are the sums shown in Table XII to be provided? Three main sources have to be considered:—

(a) the National Exchequer, that is to say, the citizens in their capacity as tax-payers;

(b) the prospective recipients of payments under the scheme, that is to say, the citizens in their capacity as insured persons;

(c) the employers of insured persons where these are employed under contract of service.

Local Authorities will also have important functions, in relation to security, mainly though not wholly in the provision of institutions, bringing in a fourth possible source — the citizens in their capacity as rate-payers. In framing the Security Budget, expenditure from local rates has been brought into account only in so far as it is concerned either with medical treatment in institutions or with public or blind assistance. This expenditure is shown in Table XIII (p. 112} combined with that falling directly on the National Exchequer, since the ultimate division of these costs between national taxation and local rates cannot yet be finally determined. The many other expenditures of local authorities on allied social services, including housing, education, and welfare of mothers and children, though closely related to social security, have not been covered by the previous discussion and axe not reckoned in the Social Security Budget.

Taxation And Contributions

- Before considering these sources, it will be convenient to state briefly the meaning attached here to the terms used in describing them. The distinction between taxation and insurance contribution is that taxation is or should be related to assumed capacity to pay rather than to the value of what the payer may expect to receive, while insurance contributions are or should be related to the value of the benefits and not to capacity to pay. Within insurance a further distinction may be drawn between voluntary and compulsory insurance. In voluntary insurance, the contribution is a premium which must be adjusted to some extent to the degree of risk; persons with low risks must be allowed to pay less for the same rate of benefit than those with high risks; otherwise they Witt not insure. In compulsory insurance, the contribution may vary with the risk but need not do so; the considerations relevant to this question are discussed in paras. 86-87. For the present purpose, of considering the three possible sources of security finance, the question of adjustment of contributions to risk in compulsory insurance is secondary. The main issue lies between taxation and insurance contribution. Taxation implies regard to means; an insurance contribution for the same benefit, whether or not it varies with the risk, should not vary with the means of the person who pays it.

-

Whatever monies are obtained under the second and third heads, from insured persons as contributors and from their employers as employers, it is certain that the National Exchequer, that is to say the citizen as tax-payer, must continue to meet a substantial part of the total expenditure shown in Table XII. Indeed, the suggestion is made sometimes that social security should be financed only by taxation. The suggestion is put, or can be put, in two alternative forms. One is that social security should be financed wholly from general taxation, that is, should become completely and formally non-contributory. The other is that social security should be financed by particular taxes assigned to this purpose. This suggestion, in either of its forms, breaks with the contributory principle and logically, as is seen by some of its advocates involves dropping .the term “insurance.” The advantages that can be claimed for the second form of this suggestion over the first form is that it maintains some connection between paying and receiving, and may make it possible to widen the basis of taxation. It might, for instance, appear easier to reconcile wage-earners to income-tax, if the proceeds were earmarked for some purpose in which wage-earners had a personal interest, just as at one time a tax on petrol was introduced specifically to improve roads for the users of vehicles driven by petrol. But the arguments against assignment of taxes to particular purposes are strong; assignment is a method rightly unpopular with those who have responsibility for framing the general budget and it is difficult to believe that it could prudently be applied to any part of a tax so fundamental as income-tax. Moreover, as the experience of the Road Fund shows, there is no assurance that the earmarking of a tax to its original purposes will be respected. But it is unnecessary here to discuss the relative advantages or disadvantages of the two forms of the suggestion to abandon insurance contribution entirely in favour of taxation according to capacity. From the point of view adopted in this Report and advocated by the great majority of the organisations and persons who gave evidence to the Committee, the suggestion involves a departure from existing practice, for which there is neither need nor justification and which conflicts with the wishes and feelings of the British democracy. The scheme of social insurance which forms the centre of the Plan for Social Security is based on maintenance of the contributory principle, that is to say, of the principle that a material part of the total cost of maintaining income under the plan shall be met from monies contributed by citizens as insured persons, on the basis of each individual paying the same contribution for the same rate of benefit. Contribution means that in their capacity as possible recipients of benefit the poorer man and the richer man are treated alike. Taxation means that the richer man, because of his capacity to pay, pays more for the general purposes of the community. These general purposes may, and in practice they must, include bearing a part of the cost of social security ; if security is to be based on the contributory principle, they cannot include bearing the whole cost.

274. The contributory principle was emphasised or accepted by all the organisations most widely representative of insured persons in Britain— notably the National Conference of Friendly Societies and the Trades Union Congress General Council. It is maintained as a central feature of the Plan for Social Security on grounds according with this expression of views. These grounds may be summarised under three heads:—

(i) The insured persons themselves can pay and like to pay, and would rather pay than not do so. It is felt and rightly felt that contribution irrespective of means is the strongest ground for repudiating a means test.

(ii) It is desirable to keep the Social Insurance Fund self-contained with defined responsibilities and defined sources of income. The citizens as insured persons should realise that they cannot get more than certain benefits for certain contributions, should have- a motive to support measures for economic administration, should not be taught to regard the State as the dispenser of gifts for which no one needs to pay. (iii) To require contribution on an insurance document for each individual has administrative convenience, particularly for a scheme which, while it covers all citizens, takes account of their different ways of livelihood, and classifies them, giving different benefits according to their needs. Contribution provides automatically the record by which the insured person’s claim to be qualified for any particular benefit can be tested.

275. There remains the question as to whether, in addition to the National Exchequer (that is to say the citizen paying as tax-payer according to capacity) and the insured person (that is to say the citizen paying at a flat rate for flat benefits irrespective of earnings and capacity), money should be obtained also from a third source, namely the employer, where the insured person is employed under a contract of service. In regard to one particular risk, that of accident and disease arising in the course of employment in hazardous industries, there is a special reason for an employer’s contribution, adjusted to the degree of risk; this reason lies in the desirability of giving a stimulus to prevention of accident and disease. Apart from this special case, the argument for keeping employers’ contributions in social insurance is not as strong as is the argument for keeping contributions from the insured persons. The present form of employers’ contribution, as a share of the cost of an insurance stamp affixed to an insurance document for each week of employment, is a tax on the giving of employment; it is not related to the employer’s profits or capacity to pay ; it varies from one employer to another in proportion to his total expenses, according as he uses much or little labour; it does not vary according to the extent to which the employer, in the management of his business, endeavours to avoid unemployment or sickness. It can be argued that, even if some form of contribution by employers as such is retained, it would be desirable to explore forms alternative to the present one, in particular the suggestion made many years ago by the Royal Commission on the Poor Laws and Relief of Distress of a tax on dismissals. But neither this suggestion nor any other alternative proposed hitherto to the present tax on employment is free from difficulties and objections.

- If a contribution by employers as such, and not as tax-payers according to capacity to pay, is to be retained, it is hard to find a practical alternative to the present system of a charge for each week of employment given. Though such a contribution can be described as a direct tax on employment, it can equally be described as an addition to wages; it does not enter into the cost of production any more or less than do wages or the contribution of the employee that is taken out of his wages; it can and should be regarded as a proper part of the cost of production, maintaining the labour force that is necessary both when it is actually working and when it is standing by. In proportion to the total cost of production, any reasonable employer’s contribution to social security is bound to be small and may be well worth making for the sake of the advantages that it brings. It is to the interest of employers as such that the employees should have security, should be properly maintained during the inevitable intervals of unemployment or of sickness, should have the content which helps to make them efficient producers. It is equally desirable, that employers should feel concerned for the lives of those who work under their control, should think of them not as instruments in production, but as human beings; most of them do feel this concern and accept and welcome the social insurance contribution as a mark of it. It is desirable finally to give to employers a definite status, based on contribution, for making representations as to the administration of social insurance and its possible improvement. On balance the arguments for maintaining a direct contribution by employers towards the costs of social security, if less strong than those for maintaining contributions by insured persons, outweigh any arguments on the other side. In the plan of this Report a substantial employer’s contribution is retained, as something to be paid irrespective of profits, in respect of each week of employment of an insured person.

Tripartite scheme of Contribution

- The finance of the Plan for Social Security is based accordingly on a continuance of the tripartite scheme of contributions established in 1911. That scheme has been in force for thirty years and has won general acceptance. The plan includes the setting up of a Social Insurance Fund from which all the benefits secured in virtue of contribution will be paid and into which money will flow in two main streams: one springing from the sale of insurance stamps and representing the joint contributions of insured persons and their employers in Class I or of insured persons alone in Classes II and IV; the other coming as a contribution from the National Exchequer out of monies raised by general taxation. The industrial levy in hazardous industries (para. 89) will provide a third lesser stream. Most, if not all, citizens of working age will pay in two ways; an insurance contribution which for equal rates of benefit will be the same for all regardless of means, and a share of national taxation, direct or indirect, adjusted to their means. Those who are employers will pay in a third capacity as well. The Social Insurance Fund will be one, but will have separate accounts for different purposes as explained in para. 42.

-

Assuming the scale of benefits set out in para. 401 the rates of contribution to be required from insured persons and employers are suggested in para. 403. The principal rates are for an adult man in Class I, 7/6 a week and for an adult woman in Class I, 6/- a week, as joint contribution from the insured person and from the employer together. The corresponding rates for other classes and for boys and girls, the possible adjustments for special cases, and the division of the joint contribution between the insured person and the employer are dealt with in paras. 403-408.

-

The considerations leading to the contributions suggested for various classes of persons are explained in the Memorandum by the Government Actuary. The main points may be summarised as follows:—

(i) The joint contributions of employers and insured persons in Class I are designed to provide two-thirds of the cost of unemployment and five-sixths of the cost of retirement pensions, of maternity and of disability (other than that covered by the industrial disability levy) in the case of new entrants to the scheme at sixteen ; the whole cost of marriage and funeral grant; five-sixths of the cost of other benefits, including widows’ and guardian benefit; and a payment towards the cost of health and rehabilitation services. The division of the joint Contributions in Class I, between insured persons and their employers, is explained in para. 280; reference should be made also to paras. 96 and 291.

(ii) The contributions of insured persons in Classes II and IV, where there is no employer, are designed to provide for the benefits given in Classes II and IV respectively the same share of the total cost as is covered in Class I by the insured person and his employer together,

(iii) Employers in industries scheduled as hazardous, in addition to their share of the joint contribution, pay an industrial levy. The levy is designed to cover two-thirds of the cost of accident and disease in such industries above the average for all other industries, the remaining third being shared between the employees and employers in all industries and the Exchequer.

(iv) Of the joint contribution in Class I named in para. 278, lOd. a week in the case of an adult man and 8d. a week in the case of an adult woman is assigned for the health and rehabilitation services, including free hospital treatment, with appropriate lower contributions for non-adults. Insured persons in Classes II and IV will contribute for these services the amount of the joint contribution in Class I.

(v) The National Exchequer provides one-third of the total cost of unemployment benefit, one-sixth of the cost of pensions and of disability and maternity benefits for new entrants at age 16, together with the cost of bringing in the existing population of all ages for the ordinary benefits at the flat rate of contribution, one-sixth of the cost of industrial disability not covered by industrial levy and the whole cost of children’s allowances and national assistance.

(vi) The National Exchequer and the local rates meet the cost of the health and rehabilitation services with the help of a grant from the Social Insurance Fund representing the receipts from the contributions assigned to these services. Division of costs between the National Exchequer and the local rates depends upon the further investigation of the finance and organisation of these services, suggested in para. 437.

(vii) The accumulated reserves in hand from the existing pensions, health and unemployment schemes are assumed to be transferred to the Social Insurance Fund and invested.

280. As regards division of the joint contribution in Class I, between insured persons and their employers, the view taken here is that it is reasonable for the cost of unemployment, of disability other than that covered by industrial levy in industries scheduled as hazardous, and of retirement pensions and widowhood to be divided equally between the two parties, for employers to continue to make a contribution towards the cost of medical treatment for their employees, for the insured persons to be charged with funeral, marriage and maternity grant and the bulk of the insurance contributions for medical treatment.

Shares of the three parties

- On the basis of the contributions suggested for different parties to the tripartite scheme of social insurance, the actual or estimated cost of the Plan for Social Security to each of the three parties at various dates is shown in Table XIII. The first column of this table gives the actual expenditure incurred on the relevant social services in 1938-39; it does not include the expenditure of individuals on medical treatment and on various forms of voluntary insurance which are included in the plan for the future. The actual expenditure today is materially above the figure for 1938-39 through granting of supplementary pensions, raising of rates of contribution and benefit, raising the remuneration limit for non-manual workers in health, pensions and unemployment insurance, lowering the pension age for women, and in other ways. The second column of the table represents an attempt to estimate the prospective cost to each party in 1945 if the existing schemes were continued at their present scales. The figures in this column are necessarily to some extent speculative. They suggest that the expenditure included in the Security Budget in 1945 as the result of the proposals made here will be in total about £265 million more than would have been so included under the existing schemes and that of this increase the amount falling on the National Exchequer and local rates will be £86 million, which may be reduced by £10 million if the suggestion made in para. 353 (5) and 270 (7) is adopted.

TABLE XIII

Estimated Cost Of Social Security To Exchequer, Insured Persons And Employers At Various Dates

| £ millions | ||||

| 1938-39 |

19 |

45 |

1965 |

|

| Present Schemes | Proposed | Proposed | ||

|

(1) |

(2) | (3) |

(4) |

|

| National Exchequer (and Local Rates for hospitals and public assistance)Insured Persons |

212 55 |

26569 | 351194 |

519 192 |

| Employers |

66 |

33 | 137 |

132 |

| Other (mainly interest) |

9 |

15 | 15 |

15 |

| Total |

342 |

432 | 697 |

858 |

Note.—The total of £212 millions shown as the national expenditure and certain local authority expenditure in 1938-39 is based on Table XXIII in Appendix B and is made up of £135-3 millions as Exchequer contribution for social insurance and assistance, £26-3 millions from the local rates on public assistance and blind assistance and £50 millions as estimated expenditure from taxation and rates on institutional medical services! The contribution from insured persons is that shown in Table XXIII. The contribution from employers is that shown in Table XXIII with an addition of £13 millions for the assumed cost of workmen’s compensation including cost of administration. The £137 million shown as receipts from employers in 1945 includes £5 million from reserves held by employers or their insurers against existing compensation claims.

- As regards the shares of the various parties the difference of £86 million to the Exchequer and local rates between the estimated costs of the present scheme and of the proposals is less than the cost of children’s allowances. The increase in the total receipts from insured persons is due only in part to the raising of the rates of contribution. Other parts represent contributions from classes not at present insured and transferred to social security, and expenditure previously met in other ways, e.g. cost of funerals and a large part of medical treatment. The increase of the employers’ contributions from £66 million in 1938-39 to £137 million in 1945 corresponds to the proposed increase in their rate of contribution. The proposals increase the total receipts from insured persons and their employers very much at the outset of the scheme, while limiting the additional cost to the Exchequer to that of children’s allowances. Thereafter the receipts from insured persons and employers remain stationary and the National Exchequer takes up the growing burden of pensions. This as explained in para. 292 accords with the requirements of financial policy. Of the estimated receipts—from insured persons of £194 millions in 1945 about £34 millions will be assigned for health and rehabilitation services in accordance with para. 279 (iv) above, and the remainder will be available for cash benefits. Of the £137 millions estimated to be received from employers in 1945, £6 million will be assigned for health and rehabilitation services and the remainder will be available for cash benefits.

Contributions in relation to benefit and capacity

- The rate of contribution from an adult man in Class I that emerges from the Memorandum of the Government Actuary on the assumptions made there is 4/3 a week. Is that a reasonable sum to ask the individual to pay for security irrespective of his means? Is it likely to be within his capacity?

An answer to these questions can be given from three standpoints: first, of looking at what the individual will get in virtue of his payment; second, of looking at what he has shown himself capable of paying and willing to pay in the past; third, by comparing his share of the total with that of the other parties. -

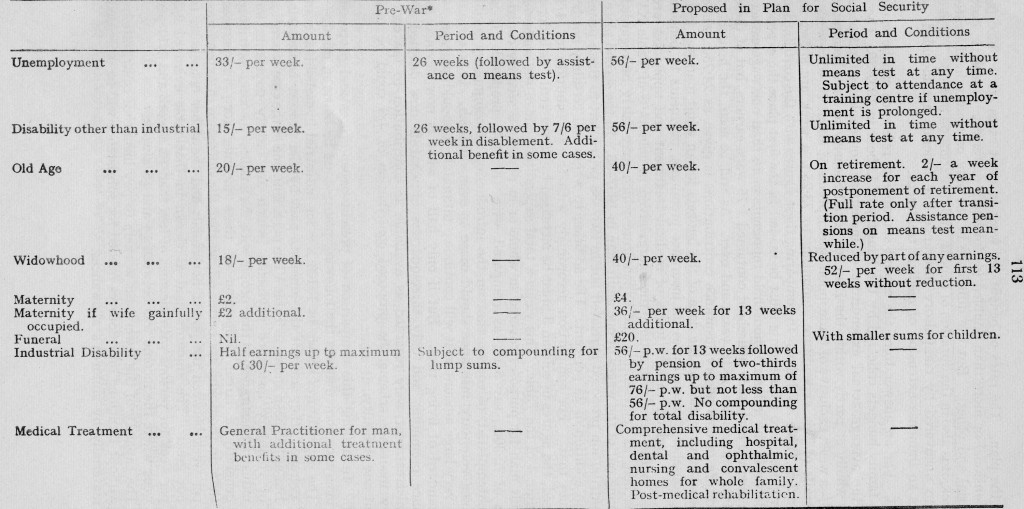

For an answer from the first standpoint material is provided by Table XIV, comparing in summary the benefits to which a contributor with family responsibilities, within the present unemployment insurance scheme, would have been entitled before the war and would be entitled under the plan of the Report in virtue of contributions and without enquiry as to his means. It does not mean, of course, that no provision of any kind, other than that shown in the Table, was made for any of the various needs before the war; both public and private hospitals, for instance, were available, subject to

examination of means or by voluntary contribution. Nor does it mean that the whole of the provision shown as proposed will be paid for out of the Social Insurance Fund, built up by insurance contributions; children’s allowances, for instance, included in the weekly amounts of benefit will be paid for wholly and medical treatment will be paid for mainly out of general taxation, national or local, and not from the Fund. But children’s allowances and treatment are part of the Plan for Social Security and will be received by every citizen requiring them without further payment or enquiry as to means. The comparison is between what a contributor of 1/7 a week could obtain as of right before the war and what a contributor of 4/3 a week will obtain as of right under the plan. The rates of benefit per week in most cases are doubled (as with pensions) or more than doubled (widowhood, maternity, disability, both industrial and other). But the difference is not only or mainly in the rates per week, it is also in the duration of benefit, and its extension of scope. Needs hitherto uncovered by compulsory insurance like funerals are included, as well as an immense extension of medical treatment.

Table XIV. Security Provision For Man, Wife And Two Children (Present Contributory Classes)

- For an answer from the second standpoint, reference can be made to the family budgets collected by the Ministry of Labour in 1937-38. These show the average actual expenditure of industrial households on purposes falling wholly or partly within the Plan for Social Security to have been more than 6/- a week, exclusive of trade union subscriptions of about Is. 4d. a week; the details of this expenditure amounting to 73.25d. a week are shown in column 2 of Table XV below. In comparing these figures with the contribution now proposed, two adjustments must be made. In the first place the expenditure shown in the industrial household represents more than one wage-earner. On an average each such household contained 1.75 wage-earners, but of these only 1.22 were males of 18 years and over. As will be seen, the household expenditure of compulsory insurance contributions is given as 24.75d. while the actual contribution at the date of the budgets for an adult man was 19d. If the household expenditures on insurance premiums, payments to pension funds, etc., and on various forms of medical treatment and appliances are reduced in the same proportion, the figures given in column 3 of Table XV are reached, as representing the expenditure which may fairly be regarded as coming out of the wages of one adult man in 1937-38. In the second place, the contribution proposed is related not to 1937-38 prices, but to those prices with an addition of 25 per cent. The addition to wages will certainly not be less than that. For comparison accordingly with the contribution of 4/3 proposed, the figures in column 3 must be increased by 25 per cent., as is done in column 4 of the Table. This yields a total expenditure out of the wages of an adult man for purposes covered in whole or in part by a security contribution of 70.30d., say 5/10, as compared with the 4/3 proposed. It is not contemplated, of course, that on the introduction of compulsory social insurance voluntary insurance should cease or even diminish. It is certain that a very large amount of it will continue; ultimately it should increase, as the standard of living rises. But if only half of what is now devoted to insurance premiums, and only three-quarters of what is now devoted to medical treatment, were regarded as available as contribution to the compulsory insurance scheme the proposed contribution of 4/3 could be met without any difficulty.

-

In making this comparison of present expenditures and proposed social insurance contributions the following points must be borne in mind:—

(1) The expenditures shown in Table XV for industrial households are an average; they are not the amounts paid by the poorest households. But as has been shown in Table VI in para. 209, one of the characteristics of voluntary insurance payments (which are largely payments for industrial assurance) is that people with the smallest income contribute generally a larger proportion of these incomes for this purpose than do those who are better off, so that the difference of expenditure per week between the poorer households and the richer households is not great. The amounts paid as shown in that table averaged 2/3 per week for persons with incomes of less than £2 a week and 2/10 per week where the income was between £4 and £5 a week.

(2) The capacity of the lower-paid workers to pay insurance contributions without trenching on resources needed for subsistence will be increased materially by children’s allowances.

TABLE XV

Expenditure on security in Industrial Households

(Pence per week)

| 1937-38 prices | |||

|

Per Adult Man |

|||

|

Per |

Per |

at |

|

| (1) |

Household |

Adult Man |

25% increase |

|

(2) |

(3) |

(4) |

|

| Insurance premiums, payments to pension funds, etc. … |

28-50 |

21-88 |

27-35 |

| Medical treatment, including hospital, doctor, dentist, optician, midwife, nursing, drugs and appliances |

20-00 |

15-36 |

19-20 |

| Compulsory insurance ………………….. |

24-75 |

19-00 |

23-75 |

| total …………….. |

73-25 |

56-24 |

70-30 |

3) Contributions for voluntary insurance must in general be paid whether the contributor is earning or not, that is to say, in unemployment, sickness and often in old age. To some extent Friendly Societies and similar organisations provide for remitting such contributions, but they cannot do so indefinitely, and the general rule of voluntary insurance is that contributions must ultimately be paid for every week, whether there are earnings or not. In social insurance on the other hand, contributions are required of employees only when wages are being earned. Social insurance, unlike voluntary insurance, gives to these contributors an additional benefit of remission of substantial contributions when, for any reason, they are not in receipt of earnings.

It is difficult, in the light of these considerations, to believe that a contribution on the scale imposed would be beyond the powers of any appreciable number of insured persons.

The Contribution of Insured Persons

- There remains the third question of the division of financial burdens between the three parties to security. There is nothing sacred about the division suggested in this Report; it is no more than a basis for discussion and argument. It is possible to argue that the contribution of employers should be reduced, at the cost either of the insured persons or of the National Exchequer. On behalf of insured persons it can be argued that even if the contribution proposed is within the capacity of most adult men, it is not within that of persons with low wages, and that these should be relieved at the cost of the tax-payer or the employer; the possibility of adjusting rates of benefit or contribution or both for particular sections of the insured population, after enquiry, is provided for in para. 408. On behalf of the Exchequer it may be pointed out that some of the expenditures proposed to be borne wholly or mainly by the Exchequer are for purposes which have hitherto been the accepted responsibilities of individuals, such as the maintenance of children or the securing of medical treatment. It may be argued that it is dangerous to shift too many financial burdens from the citizen as consumer on to the citizen as tax-payer because that may lead to extravagances. All men know of themselves as consumers but do not always realise themselves as tax-payers. All these and many other matters are open to argument. The rates of benefit contribution proposed are even more provisional, for they depend on views of financial policy and social equity as to which reasonable men may differ. All that is claimed is that the proposals made here are a fair basis for discussion, and that if the Security Budget is looked at as a whole the division proposed between the three parties is not on the face of it unreasonable. As appears from Table XII, at the end of the transition period, the total expenditure on insurance and assistance and children’s allowances and on the comprehensive health and rehabilitation services will be in the neighbourhood of £858 million a year, of which £553 million will represent cash insurance benefits and their administration. As appears from Table XIII, the total contribution by insured persons will amount to about £192 million, of which about £33 million is assigned as payment for medical treatment. If the total contribution by insured persons of all classes is compared with the total Security Budget, it represents about 22 per cent. If their contribution for cash insurance benefits is compared with the total of these benefits it amounts to 29 per cent. If their contribution for medical treatment and rehabilitation is compared with the estimated total cost of these services it amounts to about 19 per cent. These proportions include the contributions made by independent workers, employers and others in Classes II and IV. The contribution of the employees themselves will be about one-quarter of the cash benefits which they receive exclusive of children’s allowances and assistance. In terms of the debate which introduced national health insurance, the Plan for Social Security for the employee represents not 9d. for 4d., but 1/- for 3d. But this only means that citizens paying these contributions, irrespective of their earnings, will have to pay in addition as tax-payers according to capacity.

288. In the division of the joint contribution in Class I (employees under contract of service) a larger proportion is assigned to the employee than to the employer. This follows from the extension of insurance to social needs, such as the provision of medical treatment for dependants or of funerals, with which the employer has no obvious concern. In the Security Budget, the total appearing as employers’ contributions is materially less than the total of contributions from insured persons. This follows not only or mainly from the unequal division of contributions in Class I; it is due in large part to the fact that the insured persons include substantial numbers of independent workers, among them many employers, in Class II and others in Class IV. The figures in Table XIII do not mean, of course, that employers on the whole will pay less than insured persons pay. The sum shown as employers’ contributions in the Security Budget is only the sum which will be paid by employers either as share of the insurance stamp for each week of employment given by them or as industrial levy in the hazardous industries. Employers will pay also in two other ways, as themselves insured persons and if they make any profit, as tax-payers. In this last capacity as tax-payers, employers will find themselves paying a considerably larger proportion of the whole than before; the general effect of the financial proposals is to place a larger proportion of the ultimate burden upon the tax-payer than is at present the case, because he can be charged according to capacity to pay. The amount that the insured person contributes should not be governed by the amount which can safely be placed upon the employer in the form of a charge on employment. It should be high enough to give the insured person, because he has contributed substantially without reference to means, a justifiable claim to receive benefit without reference to means.

Finance of Industrial Disability

- Employers will contribute not only by a share of the insurance stamps, but if they are engaged in hazardous industries will pay also through in all cases, industrial levy a proportion of the special cost of accident and disease in those industries above the average for other industries. The general principle adopted in this Report is that in social insurance the individual has no claim to get better terms for himself because his risk is less and that in general all industries as well as all individuals, being inter-dependent on one another, should stand in together on the same conditions. This principle, explained in paras. 24-26, underlies the proposals to supersede the present system of approved societies (Change 3) to amalgamate the various schemes of unemployment insurance (Change 15) and to abolish exceptions from insurance (Change 16). But, as is shown in paras. 86-89, there is a definite social reason for keeping separate-part though not the whole, of the cost of industrial accident and disease and making a special levy on hazardous industries to meet it, in order to give to those who manage these industries a financial motive for avoidance of dangers.

-

The financial bearings of this proposal upon industries generally and upon particular industries depends both on the line taken for dividing hazardous industries from those which are not scheduled as hazardous and on the proportion of the additional cost in the hazardous industries which is borne by them as compared with the proportion that is pooled. In the Memorandum of the Government Actuary, the risk of accidents in the industries which it is not proposed to schedule is estimated to be such that if all industries had this standard risk the total cost of industrial disability would only be about £7 ½ million a year. The hazardous industries in addition to this have risks which are estimated to involve expenditure of a further £7 ½ million a year. Assuming that the industrial levy in the hazardous industries is fixed so as to meet two-thirds of this additional cost, that is to say £5 million, the remaining one-third or £2 ½ million will be pooled, that is to say, will be borne by employees and employers in all industries and the State under the general system for a collection of insurance contributions. A very considerable proportion of the £7 ½ million on expenditure above the standard occurs in coalmining. It is estimated by the Government Actuary that the proposals made in this Report will mean that accident and disease in mining will be borne by the Social Insurance Fund in relief of the mining industry to the extent of about £1 ¼ million a year. Similar though smaller subsidies in relief of their exceptional cost of accident and disease will be received by other hazardous industries such as shipping, quarries or constructional work.

-

Of the total cost of industrial accident and disease estimated at £15 million in 1945 apart from administration, £5 million, as stated, will be borne by levy and £10 million will be borne by contributions paid through insurance stamps and by proportionate grant from the National Exchequer. This £10 million represents about 3’3d. per week per adult man from employee, employer and the State. The employee’s share represents l.4d. per week. For the reasons given in para. 96 it is desirable as a matter of principle that the employee should pay this share. But, if he did not do so, it might well be argued that the total contribution should still be divided much as at present. There is no strong reason for placing on the employer any share of the ordinary widow’s benefit and still less of the guardian benefit which is concerned with the care of employees’ children. In fact it is proposed that the employer should contribute to these benefits l.7d. per week.

Changing Proportions

292. The proportions named in para. 287 relate to a period twenty years hence when the scheme for contributory pensions will be in full operation. When the scheme begins, the share of the insured persons will be greater and will decline gradually. The receipts from insured persons of all classes (including those working as employers or independent workers and those not gainfully occupied) will represent about 28 per cent, of the total Security Budget in 1945, as compared with 22 per cent, in 1965. For cash benefits alone, the share of these insured persons in 1945 will be about 44 per cent., as compared with 29 per cent, in 1965. This change of proportions follows from the fact that most insured persons must contribute for retirement pensions at subsistence level for many years before reaching the pensionable age and that the State, in place of funding these contributions, uses them to meet expenditure in providing pensions on a rising scale for the older part of the population who cannot contribute so long. To make the burden on the National Exchequer as light as possible at the outset of the scheme is in accord with the probable economic and political requirements. When hostilities end, the need for heavy expenditure from the National Exchequer will not end; it can decline only gradually as war commitments are liquidated and the permanence of peace becomes assured. Undertaking the future responsibilities of the plan for pensions is an act of faith in the building up of the national income and of the resources from which national taxation must be drawn. There is no reason to lack that faith for the future, but in the immediate aftermath of war there are strong reasons for keeping the hands of the State, as far as possible, free for expenditures which are as vital as social security, and cannot be undertaken, by anyone except the State.

-

The question may be raised whether, if necessary, the contributions of insured persons could after the beginning of the scheme be increased with a view to meeting a larger proportion of the cost of pensions. If the proposals for converting industrial assurance into a public service are accepted, there will in due course be a large saving to insured persons, both in respect of the extent of funeral insurance and in costs of administration. But this saving can only be realised gradually. And even when it is realised it may appear better to leave it as a margin for further voluntary insurance and saving than to use it to increase the compulsory contribution in relief of the tax-payer.

-

The scale of benefits that should ultimately be written into the Plan for Social Security cannot be settled now, for it depends on the future level of prices. No particular scale is an essential part of the plan itself. But there are reasons for saying that on a reasonable assumption as to the probable level of prices after the war the scale of benefit proposed or something like it is the most appropriate; there are reasons against departing materially from that scale either by way of deficiency or by way of excess. The scale of benefits is based on subsistence needs. To give less, if the individual has no other resources, means paying for unemployment or disability in lower physical efficiency; this is more costly to the community than paying in. money. To give less, because an individual has other resources, means applying a means test. It is not possible to avoid making help in some cases depend on proof of need and absence of other resources; a substantial measure of supplementation according to needs and means is necessary in the transition period of pensions, in order to avoid giving pensions in that period, at the cost often of poorer contributors, to people who do not need them and have not contributed for them. But a permanent scale of benefit below subsistence, assuming supplementation on a means test as a normal feature, cannot be defended. On the other hand, to give by compulsory insurance more than is needed for subsistence is an unnecessary interference with individual responsibilities. More can be given only by taking more in contributions or taxation. That means departing from the principle of a national minimum, above which citizens shall spend their money freely, and adopting instead the principle of regulating the lives of individuals by law. The scale of benefit suggested in this Report is a basis for discussion only. But it is based on reasons and should be changed only for better reasons.

-

Whether or not the scale of benefits suggested here as a basis of discussion be adopted, the relation between benefits and contributions remains. To give benefits at rates 25 per cent, or 50 per cent, above those suggested here means increasing the contributions of each of the three parties of the scheme in the same proportions, or increasing the share of one party to the contribution by less and of another party or parties by more. In so far as an increase of the rates of benefit and contribution suggested here was made necessary by change in the value of money, that is by a level of prices after the war materially more than 25 per cent, above the level of 1938, that would be a difference only in money terms. Wages and other incomes will presumably rise roughly in proportion to prices, and contributions in terms of money can be raised without representing a larger proportion of wages. In so far as increase of the rates of benefit and contribution above the scales proposed was dictated by social policy and not by change in the value of money, that would represent a decision to put the national minimum higher than bare subsistence.

Social Security Worth Its Money Price

-

In this part of the Report the price of social security has been shown, so far as it can now be shown, in terms of money. Is it worth the price to each of the three parties concerned in paying—insured person, employer and the State? For the insured person the answer is clear. The capacity and the desire of British people to contribute for security are among the most certain and most impressive social facts of today. They are shown in the phenomenal growth both of industrial assurance and of hospital contributory schemes. They have been shown in the work of the Unemployment Insurance Statutory Committee on every occasion when a question was raised either of extending insurance or of adjusting benefits or contributions; on every occasion the pressure has been to come into insurance rather than to keep out, and to get higher benefits rather than to pay lower contributions. There is no reason for fearing that for the ordinary industrial wage-earner a contribution on the scale suggested in this Report would be either beyond his capacity or beyond his desires. The popularity of compulsory social insurance today is established, and for good reason; by compulsory insurance, so long as it is confined to meeting essential needs, the individual can feel assured that those needs will be met with the minimum of administrative cost; by paying, not, indeed, the whole cost, but a substantial part of it as a contribution, he can feel that he is getting security not as a charity but as a right.

-

For the employer, the answer should also be clear. What he pays as insurance contribution is part of the cost of his labour—from his point of view an addition to wages. At whatever reasonable point the employer’s insurance contribution is fixed, it is a small part of his total bill for labour and of his costs of production; it is the sign of an interest which he should feel and does feel in the men whose work comes under his control.

-

For the State, the initial burden of the Social Security Budget is at most £86 million a year above that involved in the existing schemer The main burden on the State comes not now, but twenty years later, through provision for the large and growing part of the population that will be past the normal age of productive service. That is a burden which cannot be escaped the facts are inexorable; the older people will be here and will be maintained—if not by pensions in their own right, then at the cost of their individual families, by charity, or by pensions subject to a means test. The plan of this Report ensures that this inevitable burden shall be foreseen and shall be made as light as possible, by encouraging those who can work to go on working, and shall be borne fairly by the community as a whole.

-

The Social Security Budget presents figures large in relation to budgets of former time. They are not large in relation to the total national income and the Plan for Social Security is only a means of redistributing national income, so as to meet openly needs which must be met in one way or another. For reasons given in paras. 445-447 it does not seem open to question that just before the war, the British community was rich enough in real things to have avoided real want. It would be wrong not to hope that the British community can so organise itself as to be as rich again. The Social Security Budget is merely a way of translating this fact and this hope into money terms.