This is based on a press release from the revolutionary socialists of the Organisation for Economic Co-operation and Development

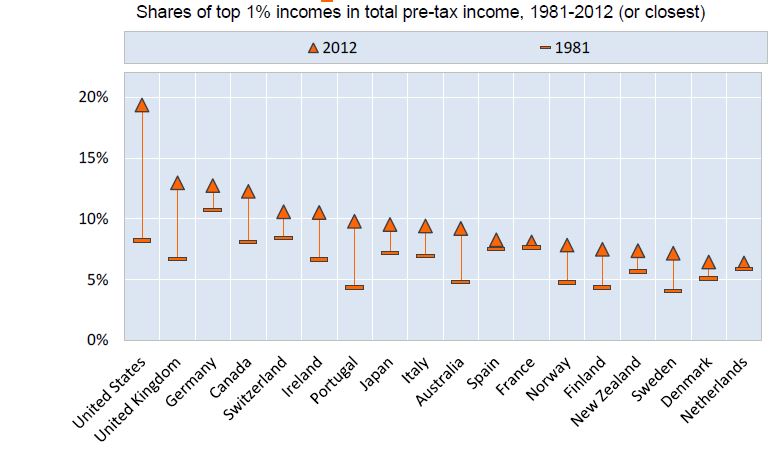

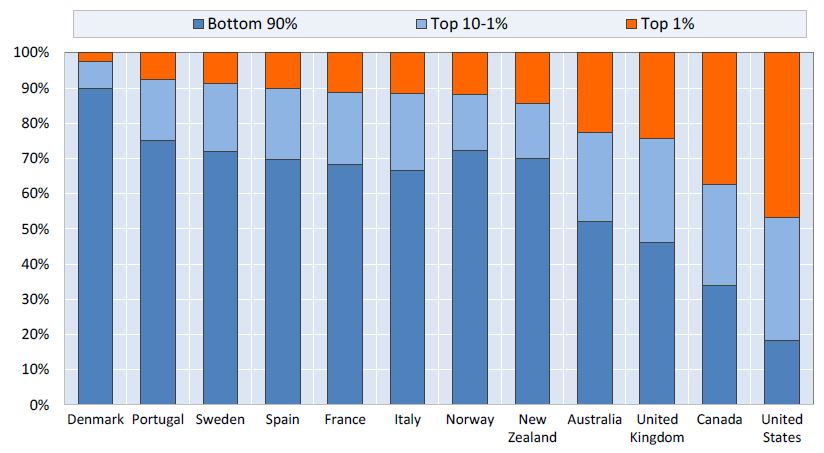

The shares of the richest 1% in total pre-tax income have increased in most OECD countries over the past three decades. This rise is the result of the top 1% capturing a disproportionate share of overall income growth over that timeframe: up to 37% in Canada and 47% in the United States, according to new OECD analysis.

Even in countries which have a history of a more equal income distribution, such as Finland, Norway and Sweden, the share of the top 1% increased by 70%, reaching around 7-8%. By contrast, top earners saw their share grow much less in some of the continental European countries, including France, the Netherlands and Spain.

But the incomes of the poorest households have not kept pace with overall income growth, with many no better off than they were in the mid-1980s. Stripping out the richest 1 percent of the population leaves income growth rates considerably lower in many countries – which is why so many people have not felt their incomes rising in line with overall economic growth.

The crisis put a temporary halt to these trends – but it did not undo the previous surge in top incomes. On average, real incomes of the top 1% increased by 4% in 2010, while the lower 90% of the population saw their real incomes stagnate.

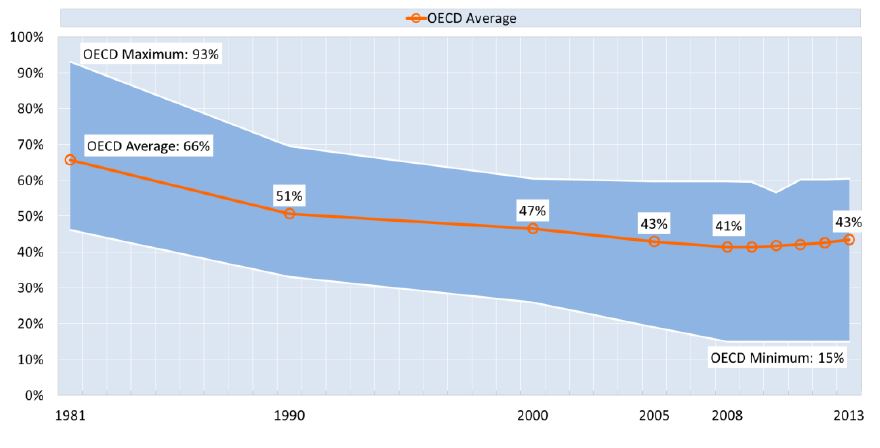

Tax reforms in almost all OECD countries over the past 30 years have substantially cut top personal income tax rates, the average rate in OECD falling from 66% in 1981 to 43% in 2013. This reduction has been closely associated with rising top income shares. Other taxes which play a role for top incomes were also lowered: the average statutory corporate income tax rate declined from 47% to 25% and taxes on dividend income for distributions of domestic source profits fell from 75% to 42%.

“Without concerted policy action, the gap between the rich and poor is likely to grow even wider in the years ahead,” said OECD Secretary-General Angel Gurría. “Therefore, it is all the more important to ensure that top earners contribute their fair share of taxes”.

The paper outlines a series of reforms governments could make to help ensure that top earners contribute their fair share of the tax burden. These include:

- Abolishing or scaling back a wide range of those tax deductions, credits and exemptions which benefit high income recipients disproportionately;

- Taxing as ordinary income all remuneration, including fringe benefits, carried interest arrangements, and stock options;

- Considering shifting the tax mix towards a greater reliance on recurrent taxes on immovable property;

- Reviewing other forms of wealth taxes such as inheritance taxes;

- Examining ways to harmonise capital and labour income taxation;

- Increasing transparency and international cooperation on tax rules to minimise “treaty shopping” (when high-income individuals and companies structure their finances to take account of favourable tax provisions in different countries) and tax optimisation;

- Broadening the tax base of the income tax, so as to reduce avoidance opportunities and thereby the elasticity of taxable income;

- Developing policies to improve transparency and tax compliance, including continued support of the international efforts, led by the OECD, to ensure the automatic exchange of information between tax authorities.

In many OECD countries, the rise in overall inequality has also been driven by low-income households falling behind in relative and, sometimes, in real terms. In order to tackle the increase of overall inequality, a comprehensive policy strategy for promoting opportunities for those at the lower end of the distribution is needed. Beyond tax reforms, such a package includes transfer policies and other social policies, as well as labour market and education policies.

The paper “Focus on Top Incomes and Taxation in OECD Countries: Was the crisis a game changer?”, all figures and data, a short video and more information on OECD work on inequality are available on the OECD website