Hermione Parker Contribution to Health, Wealth and Poverty Conference held in London November 1992

The current debate on poverty and social security reveals a widespread acceptance that existing social security systems need to be replaced. But there is a strong division of opinion between men (representing paid work) and women (representing unpaid work) about the kind of system that should replace them.

Main Reform Options

Two main reform options are on the agenda. First, a residual welfare state, by which I mean means-tested benefits for the poor (including most pensioners), and private provision (helped along by income tax reliefs) for the rest. Second, a modified Basic Income (BI), by which I mean the following:

- universal benefits (or tax credits) for everyone, financed and recouped from those who do not need them by an integrated income tax

- residence-based old age pensions

- gradual abolition of all income tax allowances, most income tax reliefs, and most existing social security benefits

- a second, much smaller layer of income-tested (not means-tested) provision for people still in need

- a reformed Social Fund (for emergencies).

Now those options could not be more different. A residual welfare state would increase the number of people living in poverty and facing very high benefit withdrawal rates, while for everybody else the rate of income tax might go down to 20% or even less. By contrast, even the modified BI that I have in mind would reduce the number of people caught in the poverty and unemployment traps, and would require a rate of income tax of about 35% (compared with 25% + 9% NI contribution at present).

I also want to stress the huge gender gap between those options. For it is men (on average) who gain from a residual welfare state, just as it is men who do best (on average) from the existing system. By contrast, it is women (on average) who would gain most from a Basic Income. Yet it is men’s opinions that dominate the debate.

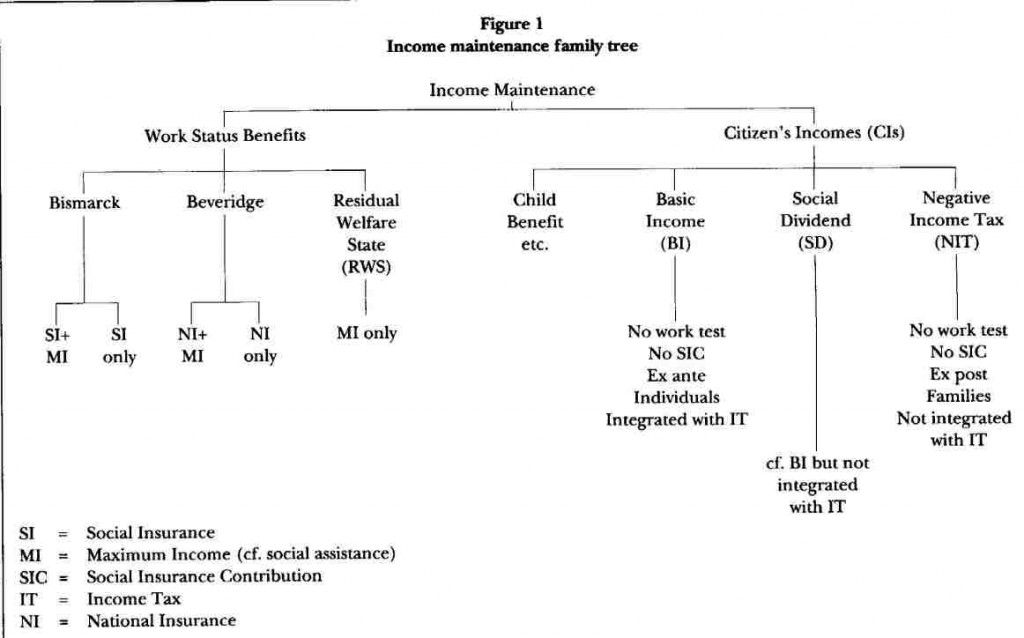

BI carries Beveridge‘s idea of a national minimum forward in line with economic, social and technological change. It makes room for the dispossessed, including disproportionate numbers of women, children, young people and people with disabilities. Later on I will explain that Basic Income is a form of Citizens Income (figure 1). And this is how a Citizens Income is defined:

For every citizen the inalienable right regardless of age, sex, race, creed, labour-market or marital status to a small but guaranteed, tax-free income, unconditionally.

In Britain the only benefit that meets these requirements is child benefit.

Europe’s New Poor

My starting point is Europe’s new poor, their low living standards, their exclusion from mainstream society, their lack of opportunities, their increasing numbers and, above all, the apparent impossibility within existing social security systems, of resolving their problems. “There is a considerable risk” wrote the European Commission in 1991, “of two different societies developing in the Member States, one of them active, well-paid, well-protected socially, and with an employment-conditioned structure; the other, poor, deprived of rights and devalued by inactivity”. Those are just the things a residual welfare state would exacerbate.

The immediate causes of the new poverty are well known: unemployment, insecurity of employment, decline of the traditional family, homelessness. What interests me most, however, are its underlying causes. Why has the new poverty spread to so many countries, despite the different policies of different governments -for instance Margaret Thatcher along side Mitterand? Is it possible that our existing social security systems, designed to remove poverty, are making it worse?

Of course it is a complex problem, but I am going to put three thoughts to you:

- Benefits that are restricted to people who are not in paid work, and removed as soon as they go back to work (like unemployment benefit) create earnings floors below which paid work may not be worthwhile (the unemployment trap). People with low earnings potential are priced out of work, especially if they have mortgage or childcare costs to pay.

- The NI contributions by which most benefits are paid for are in fact payroll taxes, which put up the price of labour, and make it uncompetitive with machinery and with uninsured labour in the developing world. Increasingly, to get a job you have to have the latest skills.

- Old age and disability pensions that are restricted to people who have been in paid work downgrade the value of unpaid work in families and communities. Too many women and men seek too few jobs, resulting in latchkey children and the early institutionalisation of old people.

Now I am not suggesting that women should stay at home. But I am trying to show the absurdity of a system that sends out messages for everybody to do paid work at the very time when the preservation of the environment requires lower economic growth rates, when new technologies are reducing the demand for labour, and when longer life expectancy is increasing the demand for the caring work that used to be done by women.

In my opinion, national insurance should be phased out – except, perhaps, on a voluntary basis. I know that millions of people benefit from it, and millions more would continue to do so. But not the poor. Which is hardly surprising, given that all systems of insurance are systems of exclusion, and national insurance is no different. In any case, why should those who work for money deserve more from society in their old age than those who work out of love or compassion for their fellow human beings? We can explain it, but I do not think we can justify it.

Beveridge’s false assumptions

The social security system introduced in Britain following the Beveridge Report never had the slightest chance of preventing poverty, because Beveridge started from a number of false assumptions – for instance that virtually all poverty results from interruption or loss of earnings, or from failure to relate income to family size (ie the number of children in the family).

Beveridge evaded the problems of low pay, divorce and separation, including lone parenthood (except widowed mothers). He also assumed that people can be neatly fitted into boxes – either in or out of work, fit or sick, single or married – which is rubbish. Earnings are often irregular and inadequate. Work does not necessarily mean full-time work. Health is part of a continuum. Also, Beveridge left students and trainees out of his proposals altogether – so it is not surprising that when there is a boom, British industry snarls up for lack of skilled workers. Basic Income would put an end to all that -everyone would get it, so training, retraining and study would be encouraged.

The welfare state of tax

Now at this point I am assuming that you understand the essentials of the existing social security system, but I wonder how much you know about the second -hidden – welfare state of tax.

In 1991 social security benefits cost about £70,000 million. Income tax allowances, by which I mean the £66 a week each of us is allowed free of tax (£99 for lone parents), cost a further £32,000 million. And tax reliefs (eg for mortgage interest and private pensions) cost a further £23,000 million. Which makes a grand total of £125,000 million – of which £70,000 million is on benefits and £55,000 million on tax foregone.

With Basic Income, all (or most of) those tax reliefs would be converted into tax-free, universal benefits (or tax credits), just as child tax allowances were converted into tax-free child benefit. The personal tax allowances would be the first to go – they could be replaced in a single Budget. The non-personal tax reliefs would take longer, because you cannot suddenly expect people to pay the whole of their mortgage, and you have to protect acquired rights.

Now the rationale for getting rid of tax allowances and reliefs is very simple. Tax allowances were introduced to prevent people being taxed on income necessary to stay out of poverty. Unfortunately, they are useless to people without the income to set against them. A tax allowance of £66 a week does not buy the groceries if you do not have £66 in the first place. Mortgage tax relief is useless if you cannot afford to buy a house. And pension tax relief is useless if you cannot afford to save. Far better, in my view, to have a Basic Income that provides the poorest with a guaranteed, no-questions-asked, cash income; tops up the incomes of the hard-pressed; and is deducted (at the same flat rate for all) from the tax bills of the rich.

Main characteristics of Basic Income

These are:

- Entitlement based on citizenship, or legal residence

- Individual assessment units

- Automated delivery

- Tax-free

- Choice

Entitlement based on citizenship

At present, entitlement to many benefits depends on work or former work status -the exceptions are child benefit, one-parent benefit and widow’s benefit. By contrast, for Basic Income the key test becomes legal residence (as with child benefit), and in the case of older people, length of residence in the UK. All work tests, including the availability for work rule and earnings restrictions, would go. An unemployed person would be encouraged to build on his BI by going out to work, without fear of prosecution. And in old age almost everyone would get a Citizens Pension.

Individual assessment units

The BIs would be paid on an individual basis to every man, woman and child, regardless of gender or marital status – although they would probably be age-related, and the child BIs would normally be paid to the mothers. The co-habitation rule would be abolished.

Automated delivery

The BIs would be credited automatically, each month, through the banking system. For people without bank accounts, special provision would be made – either through Post Offices or the provision of smart cards.

Tax-free

The BIs would be tax-free. This is in order to avoid poverty trap effects. Unlike today, nobody would be taxed on the income necessary to stay out of poverty – or be expected to claim back the tax through means-tested welfare.

Choice

BI is about giving people more choice – choice without having to refer back to the Department of Social Security (DSS), without being called a scrounger, and without jeopardising their income security in old age. Given the opportunity, and after careful explanation, I think most people would support BI, just as they support the National Health Service and child benefit.

Implications for family life and administration

The above changes would have far-reaching implications.

Family life would be strengthened by the switch from work status to residence as the basis of entitlement, and by the switch to individuals as the unit of assessment -for two reasons. First, so long as benefit entitlement is based on work status people who do not work for money are treated as second class citizens. In 1991, only 15% of women reaching state pension age were entitled to the full Category A old age pension of £52 a week; and about one-third had no entitlement to any benefit. Second, the present income support system penalises married and cohabiting couples by paying benefit amounts that are below the rate for two single people of the same sex sharing accommodation. With BI this could not happen, because the right to it would be vested in each individual as an equal citizen. Two pensioners would get double the amount for one pensioner, whether they were living together or apart. Hence some of them might be encouraged to share accommodation, and what would be wrong with that?

It is only by taking the individual as the assessment unit that you can safely automate. Imagine trying to automate a system that paid less to citizens who were married. Either legal marriage would fall out of fashion or there would have to be a draconian cohabitation rule, and the DSS would be expected to keep track of the marital circumstances of millions and millions of adults throughout each year, which is impossible. I really want to emphasise this point. Effectively-targeted, means-tested benefits on a national scale are an administrative impossibility, yet the media and some ‘experts’ seem incapable of recognising this simple truth.

One of the purposes of BI is to enable the government to take advantage of computer technology without fear of abuse. In 1992/93 the DSS is expected to spend about £3,500 million on administration -enough to raise child benefit by £5 per week. Worse still, a totally disproportionate amount of that expenditure goes on administration of unemployment benefit (21% of UB are allocated to administration); income support (15% of IS costs go on administration); and the Social Fund (a horrific 47% of SF costs go on administration). By contrast, just over 2% of child benefit is allocated to administration – and child benefit is the closest we have to a Basic Income.

Income maintenance family tree

Figure 1 distinguishes between traditional social security benefits based on work status, and a new range of benefits based on citizenship. Work status benefits are products of the industrial revolution. Work is defined as paid work – with a consequent downgrading of unpaid work – and entitlement depends either on contribution record or a test of need. Most social security systems currently in operation use a combination of contributory benefits (national insurance or social insurance) and means-tested benefits (social assistance). Elsewhere in Europe social assistance is increasingly referred to as a minimum income or even insertion income. Social insurance takes the individual as the unit of assessment, whereas social assistance takes the family or household. Neo-Liberals prefer all benefits to be family based, work-tested and means-tested, and these are shown under Residual Welfare State.

On the right of Figure 1 are the new-style benefits, based on citizenship or legal residence. As you can see, Basic Income is only one of several varieties of Citizens Income, each of which serves (or could serve) a different purpose. Basic Income should be financed by its own, integrated income tax, Social Dividend out of the profits of industry, and Negative Income Tax out of general taxation. Although none of them involves a work test, Negative income Tax is means-tested and takes the family or household (instead of the individual) as the unit of assessment, therefore some people do not count it as a Citizens Income. The only difference between BI and SD is the financing method, which is important, because there are narrow limits to the benefit amounts that can be financed through taxes on income. A new profits tax – replacing employers’ NI contributions – could reduce unemployment by reducing unit wage costs, and some or all of the revenue could be used to finance a Social Dividend.

Certain embryo Citizens Income systems already exist, including child benefit and residence-based old age pensions in Scandinavia and Canada. There is even, surprisingly, a social dividend system in the United States. It is called the Alaska Dividend Distribution Programme and it has been going since the early 1980s. Each year every man, woman and child gets a small but equal share of profits from oil extracted at Prudhoe Bay.

Targeting

People who criticise universal benefits on grounds of poor targeting generally forget the role of tax. With any benefit system, the redistributive effects -gainers and losers – depend on what economists call the tax break-even point, meaning the earnings level at which benefit received equals income tax paid.

|

Figure 2

|

||

| Tax break even points | Basic Income £30 per week | |

| 1 | Tax rate35% | |

| break-even point = £85.71 | 30*100/35=£85.71 | |

| 2 | Tax rate 25%, | |

| break-even point = £120 | 30 x 100/25 = £120 | |

| 3 | Tax rate 20%, | |

| break-even point = £150 | 30*100/20=£150 |

Obviously, if you give benefits to rich and poor alike it looks wasteful. But the overall result depends as much on the tax system by which the benefits are financed as the method of delivery. Figure 2 shows that universal BI of £30 per week, if financed by income tax at 35%, would be completely withdrawn by the time the recipient earned £86 per week – which is surely not excessive. The lower the rate of income tax, the higher the tax break-even level. So it has to be said that any sort of universal benefit sits very uneasily with the politics of the present government, which gives priority to low rates of income tax.

Introducing Basic Income

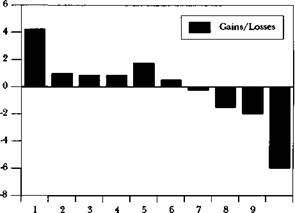

| Figure3 Redistributive effects of Bis £13 and £10 October 1991 |

| Equivalent net income deciles Total population |

During the last ten years a lot of research has been done at the London School of Economics into the financing and redistributive effects of BI. And one very clear conclusion has emerged. BI has tremendous redistributive potential from rich to poor, and from men to women -from which we concluded that it would have to be introduced in stages. Figure 3 shows the redistributive effects of an illustrative BI Phase 1 scheme, which, if introduced in October 1991, would not have required any increase in the rate of income tax or any major legislative change. With this scheme, all the personal income tax allowances except age allowance would be abolished and the Bis would be deducted from existing benefit entitlements. NI contribution would continue, but only on a temporary basis. The BI of £13 per week for adults is slightly less than the value at standard rate tax (£16.50) of the then income tax allowance, but there is also a tax credit of £5 on earned income. Losers are husbands, higher-rate taxpayers and people with investment income only. Apart from the proposed increase in child benefit to £10, which redistributes in favour of families with children, the main effect is to change the basis of entitlement to benefit, rather than increase benefit amounts. For example a pensioner wholly dependent on income support would have £13 a week as a right of citizenship, but this amount would count as a resource of income support. Even so, the average weekly gain in the bottom decile is over £4 a week and the average loss at the top is over £6.

Gainers and losers

Transitional BI scheme – Who gains and who loses?

A Gainers

- People on low incomes who don’t claim the benefits to which they are entitled

- People on low incomes without entitlement to benefit eg students, trainees and carers

- Low-to-middle-income families with children, especially single-earner families, due to:

- the extra child benefit

- the BI for non-earning mothers

- Women generally

B Losers

- People with incomes around the thresholds for higher-rate tax

- People with investment income only

- Husbands in particular, and high-earning men generally

- Lone mothers

- Invalidity pensioners.

Gainers would include low income families who at present do not claim the benefits to which they are entitled; people without entitlement of benefits, including carers, students and trainees; low-to-middle-income families with children, especially single-earner families; and women in general. Families with children gain because of the extra child benefit (£10 per child instead of £9.25 for the first child and £7.50 for other children), and the £13 BI for non-earning mothers, who at present forfeit their income tax allowance. Women would gain, some in terms of money and most in terms of financial independence, because another thing that it does is to tackle the problem of income distribution within families. Who would lose from this illustrative scheme? People with incomes above or around the thresholds for higher-rate tax would lose, because they would be charged income tax at 40% as soon as their incomes reached £23,700, instead of £23,700 plus their various income tax allowances at present. People with investment income only would lose, because the £13 BI is less than 25% of the value of the 1991 tax allowance (£16.50). Husbands would lose because their married couple’s allowance (worth £8.27 a week at standard-rate tax and more for higher-rate taxpayers) would be abolished. Lone mothers would lose, because their additional personal allowance of £8.27 a week would also be abolished. Invalidity pensioners would lose, because at present they get a tax-free invalidity benefit plus the same income tax allowances as everyone else, but with BI nobody get a tax allowance.

That is a lot of losers, and some of the losses are unacceptable. From which we must conclude that BI is not a cure-all. It has to be modified, by which I mean that there has to be supplementary provision outside the automated BI system. Lone parents are an obvious example. For them, a possible solution is the provision of guaranteed maintenance allowances (GMAs) in addition to their Bis. These GMAs could be paid automatically by the Child Support Agency, and recouped from the absent parents afterwards.

Summing up

Basic Income is no panacea. It is expensive, it would require some extremely difficult decisions. One such decision involves removal of the work test – for there are people who would oppose any modifications to the traditional work ethic. Another difficulty concerns removal of the private pension income tax reliefs – which would doubtless incur the wrath of the pensions industry. Income support could be phased out, but an element of needs-tested provision would have to remain – for instance to protect people with above-average housing costs.

The attraction of any form of Citizens Income is that work-tested provision could be abolished and means-tested provision could be hugely reduced. I think that is what the majority of people in the UK would vote for if the issues were clearly explained, and they were given the opportunity to do so. I also think that Citizens Income (perhaps a combination of Basic Income and Social Dividend) is the best way to make use of each person’s talents – much better than leaving so many to moulder in the dole queues. This conclusion should not, however, be taken to imply that other policies (eg on education and training, social housing, and childcare) are unnecessary.